Utah Industrial Snapshot 2Q24 | Manager Spotlight: Vesta Realty

The following commentary is provided by Vesta Realty Partners.

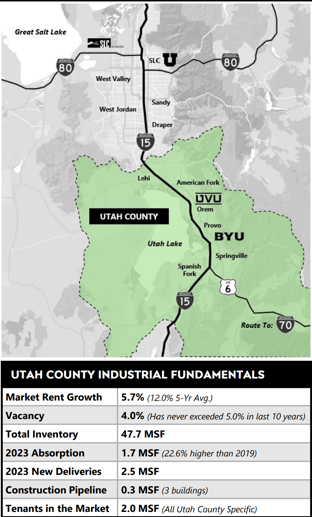

Utah County is an established logistical corridor affectionately known as "The Crossroads of the West"

-

Utah County is located within a 1-day drive to 21.2% of the U.S. population and 41.6% of U.S. maritime port volume.

-

Utah highways have the highest percentage of truck traffic in both rural and urban settings in the U.S. (29.2% and 17.1%, respectively), 2x the national average.

-

The Utah County industrial market is gaining Wasatch Front leasing market share (increased by 76% in 2023 over 8-year average) from Salt Lake County (declined by 18% in 2023 over 8-year average) due to land scarcity, labor availability, and logistical advantages.

Utah County is the Epicenter of Current and Future State Growth

-

#10 Largest-Growing County in the U.S.

-

Utah County represents the largest component of state population growth (39.2% of total state population growth 2022-2023).

-

Utah County is projected to 2x its population by 2040, becoming 82% as large as Salt Lake County.

The Utah County Industrial Market is Undersupplied Relative to Demand

-

Utah County has the 7th lowest industrial square footage per capita among MSAs with populations greater than 500,000 square feet.

-

Salt Lake County has the 7th highest industrial square footage per capita in the U.S. – emphasizing Utah’s role as a national logistics hub

-

Utah County has the 4th lowest amount of new supply relative to its existing inventory in the U.S., with 250,000 square feet under construction across three buildings.

-

There is three years of planned new supply behind the current pipeline that is expected to deliver over the next 4.5 years.

-

All of the developers who created Salt Lake City’s Northwest Quadrant (“NWQ”) submarket are in Spanish Fork, replicating the same successes, including Colmena, Wadsworth, Ritchie, and Boyer.

-

Utah County has 2.0 million square feet of tenants in the market with only 1.9 million square feet of vacancy (4.0%).

-

Since 2018, Utah County has absorbed ~100% of all new deliveries and only has 15 available suites for tenants seeking greater than 50,000 square feet of contiguous space.

-

Utah County’s industrial labor index and labor growth rates exceed Salt Lake County in 69% of key metrics. The Utah County industrial workforce headcount is on par with other regional industrial markets such as Boise and Reno.

Download Market Report

Comments